Fraud Blocker is one type of self-insurance that businesses can utilize to protect themselves from threats from the internet and safeguard their image. This article outlines the information you should be aware of when it comes to as well as the key features, learning curves and the various integrations that are available in this complete buyer’s guide for fraud blockers. When you’ve read this article you’ll have the information to benefit develop regulations that will aid in safeguarding your business from fraud.

Overview and Key aspects

A reliable fraud blocker is an essential tool to safeguard the business against fraudulent activity. In order to keep your business operating and revenue secure The Fraud Blocker was built to identify fraudulent transactions and stop them prior to they take place.

aspects of a Fraud Blocker:

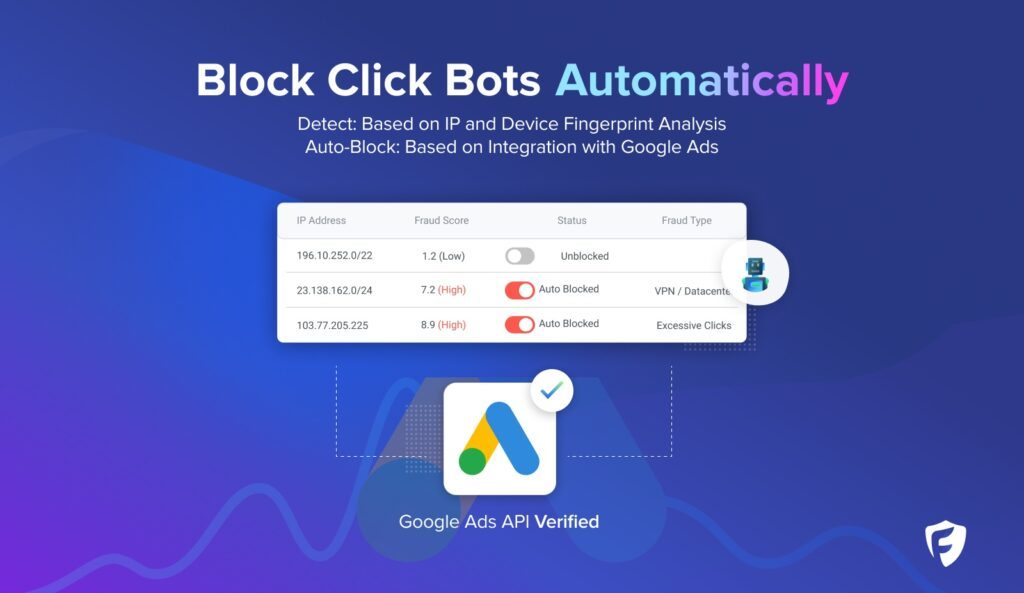

In-Depth Monitoring potent fraud blocker can monitor your transactions at a real-time rate to identify and stop fraud at the time they occur. This is also a proactive way to prevent losses to prevent your business from being impacted by fraud.

Advanced Algorithms: The heart of any effective fraud prevention tool are its algorithm. These are designed to detect patterns, alerting of fraudulent attempts, and separating genuine fraud and an imitation. The more accurate the algorithm more accurate, the less false positives and better detection of fraud.

Customizable Rules: Every company is unique in what they’re looking for so regards fraud. This is why a reliable rule-based blocker can offer you a variety of flexible rules. I’m hoping now that you discern the reason why they can benefit from your data, and more than that, it lets you customize the parameters of fraud detection to suit your their own risk and business appetite.

Detail Reporting: It’s essential to keep your security up to keep track of the kind and speed of fraudulent attempts. A good fraud blocker can create detailed reports that permit you to determine the types of frauds your business is being targeted by and how effective (or successful) your security measures are.

Usability The effectiveness of a fraud-blocker will be ineffective if it is too heavy for the average user to utilize. A user-friendly interface allows for easy navigation to allow your team to modify settings and address threats with little training requirements.

A Fraud Blocker will be an effective solution to the numerous threats that can be posed to your business due to digital fraud only when it is equipped with these crucial features. Selecting a fraud blocker that has these attributes can not only protect your sales from being harmed but it can benefit you build stronger relations of trust between you and your clients.

Ease of Use

Usability Ease of Use: This is an important issue for business owners when it comes down to picking the finest Fraud Blocker Software. A complicated system can make your work more difficult and limit your team’s ability to react swiftly in the event that you spot something amiss in one or a connected component. That’s the reason why every fraud prevention tool has to have a simple, user-friendly interface.

User-Friendly Interface:

A great fraud-blocker must have the interface simple and simple to allow users to easily navigate through it to access the various features or settings. Any modifications to rules for fraud detection and any exception review and report generation must be handled in a simple manner that reduces not just time required to get up and running with the speed learner feature for all users.

Quick Setup and Integration:

A few of the excellent fraud blockers also work well with your existing installation, and keep integration issues to a minimum. The fraud blocker must be easy to use and simple for anyone who is not a tech-savvy user or the site’s owner to install and connect to your e-commerce platform/payment gateway or CRM system with only a couple of clicks. In this case we are able to assure that your fraud detection tools are up and running and functioning properly.

Customizable Dashboards:

It’s a “My Dashboard” that can easily be modified by users to assure they only view the information that is most important to their needs. Some examples include: fraud blocking tool which allows you to concentrate on critical alerts or display KPIs or key performance indicators (KPIs)right on the top of the screen. They can utilize usability time and make sure that all information relevant is accessible at all times.

Training and Support:

Usability is also dependent on the amount of training and assistance that is provided. Your employees must know how to utilize the tool. So make sure they add several tutorials, webinars and documents to complement the fraud prevention service. Support from a responsive customer service department can assist you in navigating through the process and setting up the system.

In conclusion The technical capabilities are only relevant when it is paired with the impact of is a Fraud Blocker service can actually be based on how simple it is to utilize. With with an easy to set up, integrate and use tool, your team will be able to manage fraud prevention during this period of crisis without any unnecessary hassle and you can operate your business without many hassle.

Detection Accuracy

One of the most important factors in the performance in the effectiveness of the effectiveness of Fraud Blocker is its detection precision. If there is an boost in detection, fraudulent transactions have a greater chance of being detected early and stopped before they begin however this is accompanied by a reasonable amount of false positives that could slow legitimate transactions.

Precision — Advanced Algorithms

The level of accuracy that fraud blockers can recognize is based on the algorithms that it has put in place. In real-time, these programs sort through a myriad of data in order to identify patterns and unusual behaviors that may indicate fraud in the global market in the wake of an LikeLike fake scam. The more sophisticated and refined their algorithms, the better able the fraud blocker of deciphering legitimate purchases from potential security breach.

AI / Machine Learning and AI Integration:

A majority of them utilize machines learning, also known as artificial intelligence (AI) to improve their detection abilities over time. They employ technologies that let it learn from previous events so that when they change, they can better recognize them. The ability to boost this level of accuracy and continually is essential in order to keep it close to 100 100% detection in these ever-changing dangers.

Real-Time Threat Analysis:

Secure Fraud Blocking makes use of real-time threat assessment that determines the risk of every transaction that takes place. This ability to process it in real-time is crucial to stop fraud before it can adversely affects your business. It also allows you to take immediate action against these activities.

Minimizing False Positives:

The customers will naturally suffer due to less fraud, but it’s equally crucial that we take action to reduce the amount that are false positives. This helps assure that there is an adequate balance between detection of fraud and user-friendliness for genuine customers.

Customizable Detection Rules:

Since businesses are faced with the risk of fraud of various kinds, a reliable fraud blocker should be able to create custom detection rules. This will give the user many flexibility in how the system is designed to suit your needs, which can result in more precise detection by a higher signal-to-noise ratio (only alerting you on the kind of criminal is at fault in your business, and not ignoring any other threats that are relevant)

In the end, the precision of detection for fraud is a crucial factor in determining how effective a actual fraud Blocker is. But, a system that integrates advanced algorithmic techniques with AI capabilities, real-time analysis and customizable rules will be accurate sufficient to safeguard your company against fraud, while also permitting legitimate transactions.

Personalization and Flexibility

The main reason a Fraud Blocker specifically gives you the advantage of being able to adapt to the needs of your business. The most effective Fraud prevention system for your business Characteristics of customisation and flexible fraud rules benefit you adapt the fraud prevention program compatible the needs of your company without considering that an not-cased method can do more harm than beneficial.

Tailored Detection Rules:

Highly customizable fraud blocking rules allow you to create and alter the detection process like to your business’s specific risks. Through together the flexibility of your rules, you can choose which fraud blocker to certain types of transactions, such as mobile Payments and Cards Not Present payments (customer behaviors) or perhaps, within geographic areas that are logical. This allows you to set up your system to work in the manner that will be most efficient for your goals and, consequently, can benefit prevent false positives.

User Selectable Sensitivity Levels

Certain companies are more cautious than others. This is another reason to have the flexibility of a blocking systemthe ability to adjust detection mechanisms to improve or decrease in accordance with business needs. Perphaps if you prefer a stricter system that identifies any discrepancies, even the smallest ones or a system where it doesn’t alert until the problem is a real risk. This flexibility is essential in attempting to find the right balance between security and user experience.

Scalability Between Business Models

The fraud blocker must adjust to the growing needs of your company, whether you’re a small-scale startup or a large enterprise. This means it must be scalable to handle greater volume of transactions as your business grows and adaptable to modifications in how you conduct business or industrial forces. One of the most important ideas behind (new) security strategies is their capacity to expand without losing effectiveness and precision.

Integration with Current Systems:

A fraud prevention tool that is flexible should work with all of your system, e.g., you are able to connect and play within your existing e-commerce platform, payment gateways, or even your customer relation management (CRM) system. You should be flexible satisfying to integrate with your current technological platform and features to ensure that fraud prevention functions can be implemented without affecting the existing workflows.

User Role Management:

It is also possible to consider the possibility of customizing user roles and serve various levels of access for your team members. This ensures that only the appropriate people have access to the correct tools, but do not over complicate the your system or boost the attack surface by giving the ability to access more information than what is required.

To summarize To summarize, the best Fraud Blocker must provide flexibility and customization. Flexible fraud blockers offer the capability to directly integrate to your systems, modify the sensitivity levels to meet your needs and expand with youthis makes it much simpler for companies like yours to guard against the most sophisticated of fraudulent activities and still work within specific operational needs.

Scalability

With the expansion of the online presence of your business, it is likely that you will will face additional challenges that relate to security measures to prevent fraud. Scalability — Fraud blocker must be able to handle greater amounts, and the volume of transactions is a complete disaster even if there is massive amounts of FIG scheme that is going on with the transactions, it is not any compromise to the control of the performance or accuracy, it will make a difference.

Supporting Higher Transaction Volumes

Scalability is among the main features of the fraud blocker, so it is able to handle larger volumes of transactions as your company expands. No matter if you process hundreds or a thousand transactions per day, it’s important that your fraud blocking software can handle the load without losing its effectiveness and without compromising the accuracy of its detection. This ensures that even when your business expands in size, the security measures that you employ to prevent fraud are still effective and will deliver you with constant security against the risk of head-on computerization.

Flexibility to Scale:

It is scalable: The fraud blocker that you integrate into your website will need to grow with the expansion of your company. If you are expanding your market or the launch of new products or seasonal fluctuations the fraud blocker must be able to be able to adapt without the need for developing and re-inventing it, or requiring more resources. Therefore, your fraud prevention system stays up to date with any changes (big as or minor) you experience in your business.

Multi-Channel Operations Support

Companies often expand across multiple channels as they expand the channels they use, for example, an online store, and the mobile application that is a part of it or physical transaction. For them to actually achieve that, you need a robust fraud blocker must be able to provide protection across all of these platforms, with ease and compatibility, while maintaining the same level of detection for fraud. Businesses who want to keep an uniform and secure shopping experience without a blind spot can’t afford to focus on providing only one-channel support.

Performance Under Pressure:

Another aspect of scalability includes the capacity to perform in the face of load. The fraud prevention tool should function flawlessly during large-scale time frames like holiday sales or other promotions and be able to detect and prevent in real-time, without causing delays. The ability to scale without sacrificing performance is excellent way to test the credibility the fraud detection software.

Cost-Effective Growth:

It is essential for the fraud blocker to be scalable, so it can adapt to your business’s expansion but the growth to not be at a high expense. As your business grows the system must favor flexible pricing options which adapt to your changing needs so that you’re not paying for capacity bundles or features which aren’t needed. This efficiency in cost is crucial to ensure that you are profitable and you continue to invest in effective methods to stop fraud.

In the end it is one of the most essential aspects of Fraud Blocker and helps assure that your frauds not stall as your expansion. The scalable software can handle greater volumes of transactions dependent on the scale of your enterprise…from processing fast to supporting all-channel commerce. And it does it without burning holes in your pockets. While you continue to expand your business this is a great solution to safeguard your business from fraud.

Pricing and Plans

But the most crucial aspect and the most crucial when selecting the best Fraud Blocker for your business is understanding the way or what plans they are priced. The best solution will offer adequate protection against fraud, but cost-effective and offer worth for your money. This is why our review is so important.

Flexible Pricing Models:

The fraud-blockers give the opportunity of pricing models that can be adjusted to meet the needs of different businesses. Subscription-based pricing is an extremely popular option (pay either annually or monthly) and cost-based pricing, in which costs are determined by the volume of transactions performed and the number of the detection of fraud. This flexibility means that you choose the right plan for the size and volume of your business to warrant that you only pay for only what you really want to pay for rather than capacities or features.

Tiered Plans:

The majority of fraud blockers offer tiered plans that offer various levels of service in the process of reimbursement. The most common ground is observed in basic plans with the mandatory choice of real time monitoring and reporting of a basic level as well as higher-level packages that impart additional options such as AI-driven detection, complete analytics, or multi-channel rise. Since they come in a variety of tiers and levels, fraud blockers allow companies to begin with a plan that meets the needs of their current customers and then upgrade as their business expands.

Customizable Plans:

Certain fraud blockers provide plans that can be tailored to meet the needs of a company. This feature allows users to select options or services on their own and create the perfect plan for their specific needs. Explore the following options for extra individual plans. leading For Customizable SolutionsIdeal Customer TypesMost large-sized businesses in the mid to upper-mid range face fraud issues that standard plans are unable to fully deal with.

Free Trials and Demos:

In this regard, enough fraud blockers provide free trials as demos or trials to benefit companies evaluate their choices. You can through all the features offered by the software and test how it performs in real-world situations before committing to an account. Test it out yourself with a no-cost trial is sure to benefit you understand the way that the fraud blocker functions in conjunction with your current system and whether its features are suited to meet the requirements of your company.”

Value for Money:

Evaluation of pricing and plansCost-effective! Another way of looking at it is to consider that upgrading from a mid-range blocker may give more options and upgrades aiding you in avoiding (and most importantly, your business) any losses resulting from fraud that could cost your business money in the longer term. A low or de minimis feature could provide satisfying security for smaller companies or those that have lower transactions. The trick is to find an anti-fraud tool that hits the right balance between cost andeffectiveness.

In the end pricing, features and price that are acceptable for the Fraud Blocker should be evaluated attentively to grant a true value for the money you spend. Beginning with sharing Anycast IPs to set the basic plan to infinite advanced features, the most effective fraud blocker will deliver various options that are tiered with prices that are scalable with the addition of modifications based on the need and budget.

Customer Support and Service

Customer Support: An essential element that determines the level of service you get. The desirable tools available can be useless when there’s no one to go when benefit is needed.

Availability of Support:

Accessibility is one of the most essential customer support elements for any fraud-blocker Optimal providers must have 24/7 customer service and it’s worth mentioning the fact that they will be within your time zone or time during the week. This availability 24/7 is the crucial factor when an emergency occurs and a potential fraud endeavor must be dealt with promptly.

Multiple Support Channels:

The perfect provider of fraud prevention includes email, phone live chat, and an live chat and an online benefit center. It is possible to support these options to benefit you choose the most efficient method of getting benefit by speaking to the representative, making an request for assistance or reading useful information that you can do yourself.

Expertise and Responsiveness:

It’s not only about the availability, it also depends in the caliber of customer support. If you have a fraud blocker that is effective you’ll have an expert customer support team that can spot and address any issues swiftly. Most important is that they must be flexible — you want to be assured that your concerns can be resolved quickly and without any interruption to the world outside.

Extensive Training and Onboarding

The organizations must also integrate new team members to the fraud blocking solutions, particularly when they have advanced features. Many fraud blocker vendors offer comprehensive onboarding programs, which include tutorials, webinars, and 1-on-1 training sessions to benefit you accurate make use of the software. Onboard training can help you protect yourself from learning curve of this wonderful service system.

Ongoing Support and Updates:

It is an ever-changing field and a reputable fraud blocking service will offer assistance along with updates in order to assure the deterrence of fraud. This includes future software updates which include new features and boost the ones already in place, and prepare support as your business grows and your requirements evolving. Constant reinforcements and assistance for your fraud prevention strategies ensure that they are always up-to-date and not stale threats.

Earliest Examples of Customer Feedback and Community:.

The majority of fraud blocker providers also have a type of community that they place their customers on, either through user groups, forums or channels for customer feedback. Joining a community in this manner will provide you with extra information tips, hints and accurate methods to use this fraud-blocker. In addition, companies that actively seek and take action on feedback will also be working to make the most improvement.

Support Human Component At the end of the day customer support is a crucial element in the an effective implementation of a fraud-blocker. With 24-hour access across all platforms, you can reach out with more than one way and receive benefit by a staff who is knowledgeable about fraud prevention and makes sure you have the most up-to-date equipment to keep your business secure.

Integration with other tools

In today’s highly digital world any business looking to prosper must utilize many software options. This being said that a Fraud Blocker needs to work to be integrated with these mastered aspects of fraud prevention and detection so that the wheel doesn’t have to be recreated repeatedly, thereby requiring more effort, but actually maximizing outcome!

Compatibility with online Retailing Platforms:

E-commerce is one of the most crucial areas which is where integration becomes crucial. A fraud blocker needs to be compatible with popular platforms such as Shopify, WooCommerce or Magestos as well as other platforms. This is a fantastic option to safeguard your online store from fraudulent transactions without requiring clever hacks or additional plugins. This lets you be in the loop fraud prevention and detection in the same time as your e-commerce system that is better to secure than ever before and speed of response.

Payment Gateway Integration

Another crucial aspect of integration for a fraud-blocker is payments gateways. The fraud blocker must be able to seamlessly integrate with any payment processor you choose to use for payment, like PayPal or Stripe by analyzing transactions in real-time. Integration is essential to detect and flag suspicious activities that could be fraudulent, so chargesbacks could be issued, or financial losses could be incurred due to your payment processing aren’t secure.

CRM & Customer Data Management:

When you connect your fraud blocker to customer relationship management (CRM) tools like Salesforce or HubSpot this can provide a more complete approach to preventing fraud. When you mix customer information together with the monitoring of transactions, you begin to recognize patterns that appear unusual that could indicate fraud. This allows for individualized responses to fraudulent attempts too as automatically tagging customers that are considered to be at risk and advising them that they require more investigation.

They also have an API, as well as third-party integrations

Best API Support A good fruad blocker must include a wide range of APIs which can be connected to other software and solutions. API Integrations let you simplify the detection process which improves the efficiency of your workflow and overall effectiveness of your fraud prevention strategies. It can easily interface with reporting tools, analytics tools solutions, and the plethora of customized applications that your team can employ to manage your transactions (and other functions) in your behalf.

Centralized Dashboard and Reporting! !

This connection between systems must to be running concurrently with the method you use to manage and process the information. A fraud prevention tool worth with is one that has a central dashboard where you are able to monitor and control all connections there. Here’s an example of how it could look like below: This provides the possibility of centralizing surveillance and making smart choices. Integrated Robotic Process Automation also has reporting functions which lets you collect information from diverse sources and gain an eye-to-eye view of your fraud prevention strategies.

Future-Proofing and Scalability

The fraud prevention solution you choose to use should be able to easily and seamlessly grow with your business and also be able to integrate with any new tool that your team uses. Being able to warrant the future of your fraud prevention solution means that you’ll be able to integrate the latest technology and platforms to keep your business secure as operations expand.

This is one of the capabilities that are essential to implement in order review solutions and is frequently repeatedly asked by prospective customers is that we provide it right out of the box in order to tell an integration stories. How can this work with other components? It doesn’t matter if it’s your e-commerce platforms and CRM systems, payment gateways or any other applications from third parties, seamless integration makes sure that your strategies for preventing fraud are in sync across the company, providing 360-degree security of omnichannel with no hindering the workflow.

Security and Compliance

Whatever happens, do not compromise security or compliance when protecting your business from fraud. These aspects are essential to safeguard your personal information, keep your customers’ trust and ensure compliance with the regulatory requirements for their industry.

Data Security:

The primary focus of any fraud prevention software is to warrant the safety and security of information. The system should incorporate accurate methods of encryption to protect sensitive data in motion and at halt. This includes payment information from customers as well as transaction records and personal data. Make sure that your fraud blocking software is together robust encryption protocols to block hackers from gaining access to or stealing information which could affect the efficiency of your business.

Adherence to Market Standards

Another important aspect of the security system a fraud prevention software must meet is the compliance. If your company be in the field of specialized expertise, there might be certain rules and standards that the fraud prevention tool has to adhere to. For instance, businesses who manage information about payment cards must adhere to guidelines set by the Payment Card Industry Data Security Standard (PCI DSS) A legitimate fraud blocker for your company is designed to ensure that you meet the requirements to ensure overall compliance, thereby decreasing the risk of receiving hefty legal penalties and fines.

Regular Security Checks & Updates.

It should be secured through a security audit and updating it frequently to stop the fraud. The purpose of these audits is to find the weaknesses in the system and fix the issues as quickly as is possible. Ensure that you have installed all updates to software aids in ensuring security of the system because they often contain patches for flaws discovered in the past as well as enhancements to the current cyber security.

RBAC — Role-Based Access Control

RBAC (Role-Based access Control)This is vital for the security of your fraud prevention. RBAC allows you to decide the permissions that a specific user will is granted access to according to the function that he is playing in the company. In turn only those who have the appropriate authorizations are able to acquire access to features of high value and data, thereby reducing the risk of internal theft or accidental disclosure.

Reporting requirements and documents:

A reliable fraud prevention tool is also equipped with the ability to monitor compliance and report on regulation tools. These tools let you generate reports that indicate how well you’re in compliance with the various standards and regulations. Documentation that is clear and accessible reports are crucial for not just audits, but also external and internal verification. This can save your business time and resources to provide verification of compliance.

Incident Response and Recovery

If there was ever a breach within the network defenses you put in place to safeguard your IT system as well as stored data, a well-designed incident response plan will be able to help. The most important capabilities should revolve focused on fast detection, resolution to and recovery following security breaches in order that a good fraud-blocker has these capabilities to stay active. These could contain alerts as well as detailed logs of unacceptable behavior, and recovery methods to swiftly erase the impact of a security breach. A high-quality incident response capability means that your business will be able to reduce the damage caused through a security breach and regain normal operations.

In the end, a reliable Fraud Blocker should be built in security, and compliance. A fraud blocker will ensure that your company is protected and secure from the fraudulent actions of cybercriminals, while keeping the industry’s regulations in check. It does this by satisfying regulators by taking care of security and data protection through regular audits that reduce the risk. This is done by with RBAC or Role-based access Control (RBAC) functions, in addition to compliance reporting. This safeguards your business well as helping to build trust in your brand by verifying charitable claims.

User Reviews and Case Studies

For the future, be aware that trying out the Fraud Blocker using real user reviews and case studies could provide us with an idea of how old is the product actually. These sources benefit users to comprehend the fraud prevention tool in use, the benefits it offers to other companies, and what they comment on how well it performs.

Consumer Feedback: User Reviews

Reviewers: This is another method to receive direct feedback from businesses who have tried the fraud blocking. They will typically discuss what the strongest elements and weak links are of a particular VPN in order to give the user with an idea of what to anticipate. It will be a matter of the ease of use as well as how accurate the detection is, and great customer service. What do Your FriendsList users who have tried the VPN consider when with it? Reviewing a variety of reviews will allow you to know how the fraud blocker works in various settings and fields and allows you to make a more informed decision.

Commonly Praised Characteristics:

The fraud blocker has been well reviewed by users in a variety of user reviews. Some aspects appear on variety of occasions. For instance, an easier-to-use interface to fine-tune fraud management, or clever people working in the background to benefit identify and stop criminal activities. Another user might mention that the customizable settings means that the fraud blocker can be set up adequate to your specific needs. Understanding the scope of these recognitions will help you to understand the features are included in the fraud blocker that could benefit your business.

Case Studies (In-Depth Success Stories)

There is a chance to find out a lot about a different business’s experience in being successfully efficaciously make use of the fraud blocker by reading cases studies. These studies typically give an insight into the problems they encountered and also details about the place they used the fraud blocker and what the final outcome was. An online marketplace may have observed that fraudulent transactions decreased as a retailer began to cut down on chargebacks by 50 percent after using this fraud-blocker.

Industry-Specific Insights:

The case studies of fraud blockers expose the functioning of how it operates across various industries, including E-commerce and Financial industry, as well as Digital services. It is possible to find these particular examples of industry specific to your company operates located in the same field and can benefit you understand the possibility of modifications to address the specific issues of your specific vertical. Examine your industry’s specifics, and examples of what you do to warrant that you’re confident that the fraud blocker will customize its services to meet your requirements.

Long-Term Impact:

User reviews and case studies always include a discussion of the effect of the fraud blocking software on customers. This includes security improvements as well as customer trust and business payoff. When you know the long-term effects they will provide background to how large the potential ROI (ROI) for your fraud prevention tool could be and benefit to your case to the required individuals who make the final decision.

Making an Informed Choice:

When you mix and match data from customer feedback and the payoff of the case studies that have been conducted in the past, it’s more easy to choose the most effective fraud-blocker for your company. It is essential to understand the actual performance of the product, and these sources can provide this kind of data in a comprehensive manner, regardless of where your preferences lie, and then you’ll be able to select the accurate approach for your needs.

To summarise customer feedback, user reviews as well as case studies are vital when assessing the effectiveness of a Fraud Blocker. Dennis included a selection of them due to their real-world experience and detailed experiences that can provide specific industry-specific solutions. When you conduct your due diligence by examining these sources and analyzing them, you can warrant that the fraud prevention tool you select will help your business and impart long-term return on investment.

Conclusion

Selecting the best Fraud Blocker can be a challenging choice for any business that is at risk of falling victim to the ever-growing threat from online honchos. The product addresses everything from the accuracy of detection as well as ease of use and flexibility to pricing, scalability and integration with other tools in a contextually relevant manner to benefit you make an informed choice that is not just suited to your current needs but is also a good fit when your business expands.

Understanding the security and compliance concerns can help warrant your efforts to prevent fraud are in line with the current standards, safeguarding not only your personal information, but also the trust you’ve established with your clients. Furthermore an excellent level of support and customer service guarantees that you will never be caught out in the cold; user testimonials and cases are able to benefit to understand the situation by providing a real-world example of the effectiveness of the fraud-blocker in the real world.

At the end of the day, choosing the desirable fraud prevention software will allow your company to navigate virtual resources more easily and efficaciously and provide payoff within a matter of seconds after initial verification of the customer. You can make plans and choose by examining the elements in this post to make the right choice to ensure that your company is able to handle every type of fraud prevention issue in the near future as well as the rest of time.